INCREASING GOVERNMENT SPENDING AT A RATE THAT ULTIMATELY DEBASES THE CURRENCY

Inflation is a deadly problem, and unpredictable changes in the inflation rate (currency debasement) make it an even more deadly hazard to future economic well-being by increasing the risk of any investment and other economic activities. The risk is compounded if the investment proceeds are subject to an income tax, particularly a progressive rate income tax and/or a capital gains tax. More risk results in less investment, leading to lower income growth and fewer jobs.

Under the classic world gold standard in the century before 1914, there were relatively low currency and exchange rate risks, leading to widespread global economic growth and prosperity.

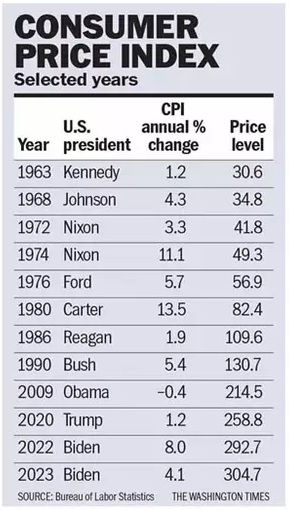

The enclosed table shows how erratic inflation has been over the last 60 years. Inflation was low during the Eisenhower and Kennedy years. President Lyndon B. Johnson presided over a big expansion of the welfare state and the buildup for the Vietnam war – much of it funded through debt – leading to the “great inflation” (1973 -1982), which peaked in 1980 under President Jimmy Carter with a 13.5% rate. Fed Chairman Paul Volcker was given much credit for killing inflation, which dropped to 3.2% in 1983 during the Reagan administration. The inflation rate, with a few small bumps, drifted down over the next 37 years, averaging less than 2% during the Trump administration.

All seemed to be well until the COVID-19 pandemic hit, and Congress decided to give businesses and taxpayers “free” money to offset their loss in income. Inflation soared because the new money was largely divorced from the production of new goods and services. This effect was predicted by most except for official Washington, who knowingly was unsurprisingly surprised by the obvious.

During the 20th century, the U.S. dollar replaced the gold standard as the de-facto world currency, in that most internationally traded commodities like oil and copper are priced in dollars. Most international transactions are settled through banks having accounts at the Federal Reserve, either directly or indirectly. Most countries keep more of their reserves in U.S. dollar financial instruments than in any other currency. Being the world reserve currency gives the U.S. regulatory and senior age advantages that other countries do not enjoy. Countries like China, Russia, Iran, Brazil and others resent this U.S. advantage. They are actively seeking ways to create a money competitor. Still, it is not easily done because it requires great faith in the quality and reliability of the reserve country’s assets and systems. The Russians and Chinese are now engaged in major trade with each other – the Chinese need Russian oil and other raw materials, and the Russians need Chinese commercial and consumer goods unavailable from the West because of the sanctions. They are doing this outside the dollar sphere by using the Chinese currency.

The Consumer Price Index (CPI) uses 1913 as the base year for measuring price changes, but most of the goods and services now consumed did not exist in 1913, so price comparisons are hard to make. A 1913 Model T automobile has more in common with a golf cart than a new Ford sedan.

In 1913, the average worker had to work about an hour (18 cents) to buy a gallon of gasoline, but now, an average worker can buy about five gallons of gasoline for each hour’s work. In 1915, it cost $20.70 (or roughly 100 hours of work) for a three-minute phone call to California from New York, and now it is almost free (zero work hours).

Advances in productivity and technology make most everything less expensive, as measured by hours worked. But the government makes everything, as measured by nominal dollars, more expensive by debasing the currency’s value. The political class learned that up to a low limit (2 to 3% per year), taxpayers will accept this inflation tax more readily than higher explicit taxes and that higher inflation rates are economic and political killers.

Competent government authorities have demonstrated they have the technical knowledge to keep inflation low, provided the growth in government spending is restrained. Outstanding economic scholars like John Cochrane and John Taylor, both now at the Hoover Institution at Stanford University, have written detailed explanations of how inflation works, as well as rules and policies for managing it.

The problem, as Nobel Laureate F. A. Hayek explained so well in his 1976 book “Denationalization of Money” is that the political class can never resist (at least since the Roman Emperor Diocletian in the 3rd century AD) increasing government spending at a rate that ultimately debases the currency – and the only solution is the private issue of money.

Private producers of things that have some aspects of money, like Bitcoin and various forms of digital gold, find themselves in an endless war with government bureaucratic oppressors. Fortunately, the most clever people are outside of government – meaning private parties – and will increasingly offer instruments and tools that provide many of the functions of money – including means of exchange, units of account, and stores of value.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2024/mar/4/inflation-and-search-for-stable-money/

© Copyright 2024 The Washington Times, LLC.