“Every election is a sort of advance auction sale of stolen goods.” — H.L. Mencken

What ever happened to fiscal discipline? It seems that each week, President Biden announces another group, such as government employees, will have their college debts forgiven — even though the Supreme Court said the president does not have the power to forgive these debts. In reality, the debts are not “forgiven.” They are merely shifted from the people who incurred them to the taxpayers at large — which only Congress has the legal authority to do. But why pay attention to the Constitution or the budget — oh, never mind, they are only words and numbers. As the late great economist Walter Williams wrote, “If one person has a right to something he did not earn, of necessity it requires that another person not have a right to something he did earn.” I expect Williams would not be a fan of the illegal aliens receiving payments and benefits from tax-paying citizens.

Last week, Mr. Biden announced that the federal government would pay to replace the huge bridge that collapsed in the Baltimore harbor. More precisely, the president implicitly said that taxpayers across the country would pay for the bridge replacement (that is, if Congress agrees) rather than the good people of Baltimore and surrounding areas who actually use and reap the benefits of the bridge.

Well before the country was formed, there was a long-standing tradition that those who directly benefited from infrastructure improvements ought to pay for them (with a few exceptions, e.g., lighthouses and draining malaria swamps). Many roads and bridges were built by private parties or by local and state governments that charged tolls for their use. (Some old roads, as well as some of the modern Interstate highways, have “pike” in their name, which refers to the pole that blocked the usage of the road until it was turned — i.e., turnpike — to open it after the toll was paid.)

Many large bridges — owned by government entities — charge tolls for their use. Typically, a bond issue is sold to fund the construction of the bridge, and the tolls are used to pay off the principal and interest on the bonds. Some states, including Virginia, have contracted with large construction companies to build and operate (including the collection of tolls) major highways or other transportation infrastructure projects. All of this makes sense in that those who directly benefit pay the costs.

When all spending comes out of a common pot unrelated to its funding, it is too often viewed as “free money” by politicians and many citizens who fail to think through the consequences.

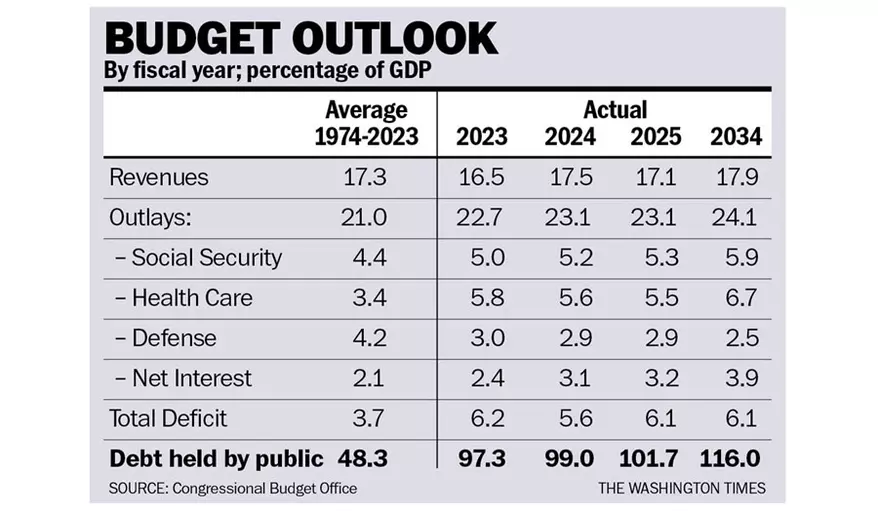

For the last half century, federal revenue as a percentage of gross domestic product was remarkably constant, typically in the 17% to 18% range, despite huge changes in tax rates. Federal spending typically bounced around in the 18% to 20% range, depending on the strength of the economy. Deficits fluctuated from small surpluses to about the 10% range. Then the COVID-19 pandemic hit, and many operations in both governments and businesses shut down. GDP dropped, and the deficit soared to about 15% of GDP in 2020.

People were getting “free money” checks from the federal government, even though they were not producing goods and services. It seems that only the Federal Reserve and the Treasury Department were surprised that inflation soared after the spending binge. Inflation was 1.8% in 2019 and 8.0% in 2022. (Note: A number of factors affect inflation in addition to government budget deficits, including changes in productivity, velocity of money, and exogenous events.)

The attached table contains data provided by the nonpartisan Congressional Budget Office. It is the best-case, even optimistic scenario. It assumes no new costly wars — a more peaceful world. It does not contain a provision for a new pandemic or major recession, both of which would make the forecast numbers irrelevant.

Most of our political leaders appear not to take the government spending problem with the seriousness that is called for. Mr. Biden, in particular, seems to have little concern. Is it because, at his age, the long run is not likely to be very long? Or is it that he has never run a business where the failure to keep revenue ahead of expenditures can have dire consequences? Unlike the federal government, a business cannot just print money.

When pressed, Mr. Biden says the rich should pay more, even though the top 1% pays 45.8% of total income taxes, almost double their share of income (26.3%). Rich tax slaves know how to go on strike.

Of course, it is possible that the rosy scenario will occur — no wars, pandemics or recessions, and a huge surge in productivity because of artificial intelligence. But do you want to bet your financial and personal future on such a potential nirvana?

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2024/apr/1/bingeing-on-free-money-at-taxpayers-expense/

© Copyright 2024 The Washington Times, LLC.